Ethereum has lost it’s way.

Ethereum has truly lost it’s way.

Now, what do I mean by this? Well, let’s use an example. offchain gasless signatures are one of the most vital pieces of ethereum architecture right now. EIP-712.

EIP-712 is a great EIP. It’s overuse in current ethereum products is not great. It’s a prime example of what I’m talking about above. In 2021, gas fees were incredibly expensive. no one, not even eth users (with lots of etheriums) enjoyed transacting onchain. Projects that were active then had to solve this issue. We started adopting and using gasless signatures because, hey, they’re gasless. Fees were incredibly high, and the helped cut those fees to zero! Amazing 0–1 UX boost.

Yet…

No one knows how to read gasless signatures. Overreliance on them has bred an army of people who are effectively trained to click confirm on all signatures. It’s a horrendous attack vector that abuses the EOA’s reliance on centralised services to tell them what they’re signing (if they even end up reading the signature, most dont (and shouldn’t have to!!!))

We aren’t in 2021 anymore. A TXN on eth isnt $100 anymore. The space has evolved since then. Yet most of the projects looking to build now are building on the same principles of solutions to issues we had in 2021 (issues that no longer exist). we have a bajillion L2s with sub $0.01 fees. Yet there is still this perverse obsession with gasless signatures, what should be a byproduct of a forgotten era.

Why?

Since crypto is such a wild west of new ideas, innovations, projects and concepts that can go in any direction, the space naturally tends to stick to the things that work. Building something new is risky, especially in crypto where a misshap could result in users losing all their money. Uniswap launches, is incredibly sucesful, and 50 other people launch uniswap forks. An L1 (eth killer) does well, and suddenly 500 VCs are funding 500 different eth killers, following the exact same playbook. It’s a weird irony, but due to there being so many different interesting new things possible, people tend to..not innovate. We stick to what we know and trust.

EIP 4337 was designed by people who don’t really transact on chain.

I don’t mean this in a harsh way, or a rude way, but just a simple observation that there are effectively 4 types of ethereum people.

Devs. The majority of devs are building for a market sector they don’t understand (thru bad fortune or a sad twist from god, it is INCREDIBLY hard to find a good dev who is also a good trader.) This natural disconnect leads to devs usually staying away from the pieces of ethereum that have the most usage/interaction, the trading pieces. This means the products and tools that get the most usage, get the least hands on crafting from experts of the sector.

DeFi guys. Now these are the guys who get the mix between dev and trader space the best. Alas DeFi is relatively dead for various reasons (stuff like ethena may respark this sector a bit, but will follow the same curve as all yield dependant protocols). So most of these guys are sticking to MeV (and blur farming) and so kind of checked out from being on the frontlines. This is a shame, as these were our most onchain active soldiers.

Traders and users. I will combine this group of people into one section as I fundamentally believe they are the same thing. These are the end user of ethereum. SocialFi, shitcoin trading, yield farming yada yada. They do most of it. They are the best person to talk to interms of understanding current ethereum UX.

Founders. Now, founders generally spot something they can build of value, then build that thing of value. Alot of the time they start with good intentions, but either through trying to maximize value capture, or a userbase that turns toxic once price stops doing too well, or something else, they become jaded. In crypto everyone is a backseat driver. If you do not have infinite faith in what you are doing and building (which in a space as fast evolving and moving as crypto can be hard. Metas change from day to day.) You are prone to pivots, moves, dances, trying to time the market.

Unfortunately, this hodgepodge of seperated entities has created an ecosystem where the core user and the core developer are fundamentally not aligned or building for each other. It’s walled gardens on either side. Devs are building for this mysterious “next 1 billion users”, trying to *guess* what they want to see. 4337 is a prime example of this.

Historical precedent:

2021: project raises during a time gas is very high. Everyone starts using gasless offchain signatures because onchain txns are $50+

2024: gas is much lower. L2s exist. onchain txns can be $>0.01. Yet we are still using offchain signatures even tho they are 1) offchain 2) the greatest attack vector for drains. People try to counter this via new EIPs, smart wallets, etc etc. No one is trying to solve the root of the problem, only trying to ease its symptoms.

Ethereum has a fear of L2s.

This is an interesting one to talk about, and probably (one of lol) the more controversial points of this post. The L2 ecosystem is a hodge podge of people saying “hey, we are all in this together, wagmi wagmi wagmi” while secretly planning out how *they* can be the dominant chain. Polygon was a prime example of this in ’21, and in ’24 another prime example of this is _______ (fill this in yourself lol) . Instead of one EVM monolith we have Ethereum, and 50 Ethereum Lites, all competing with each other.

People are finally realizing, and unfortunately this realization is causing people in the ethereum ecosystem to *fully* stray away from the L2 scaling method, and instead try and perform bizarre miracles on ethereum natively to try and boost UX/UI. This is fundamentally why concepts like EIP 4337 exists. It’s a well intentioned but badly construed system of trying to create an ethereum ecosystem that rivals those that can be natively offered on L2s/Sol (albeit a decentralized method, which is always preferred). It is however futile. Not only does it open up EOAs to more risks (signature based anything fkn sucks guys, pls, stop going in this direction) It also doesn’t instinctively solve any of the concerns people have for “onboarding the next 1 billion users”. Gas can be reduced, but it will never not be expensive on ethereum. The angle of trying to add ontop of the existing EOA addresses is good and one of the hallmarks of what decentralization is meant to be about (You can go from 100% decentralized to 0% decentralized, you have choice) , (smart wallets are another kind of fun concept that unfortunately will impact 1% of users, as getting anyone to shift over from an existing EOA they have on metamask or whatever is going to be nigh impossible)

This is why scaling on ethereum has taken a strong hit. What was previously the greatest way of proposed ethereum scaling, L2s, is now a place most try and avoid, worried they are giving more of the ethereum narrative and power away to projects parading around as “ethereum aligned”. We put our heads in the sand and just hold tight praying for zk. I think this is the most fundamental mistake the ethereum dev community could be making right now. The EVM is amazing. Yet, we are all making this mistake because we are obsessed with TVL. All anyone cares about is TVL. TVL this TVL that, how bout you TVL some… you get the drift. My core takeaway from this piece (there are multiple but core core core one) is that it helps people readjust how they view ETH, L2s, etc. L2s are amazing tool for scaling that can be used for offloading a lot of the non-value transfer aspects of ethereum transactions.

Controversial Opinion deuce: Private keys are fine

Private keys are fine. No really. Normies aren’t running away from crypto because (oh no, if i lose my private key i lose the address forever). The worlds 2nd largest company, with products in the hands of billions of people, is heading into a pro private key future. Trying to abstract private keys away is heinous. They are the core of the crypto aspect of cryptocurrencies (literally, lol)

We need to abstract chain abstraction from the chain.

Now, I’m not against account abstraction. I think tooling like gnosis (safe), multisend etc are awesome. I am not however a fan of having them be implemented into one size fits all smart wallet packages. You are removing control from the private key to centralised services. By trying to combine everything into one package, you are just making as large a bounty as possible. It’s a very holistic insight into what is fundamentally the entire problem here. In a bid to gain mass adoption, as other chains like solana *seem* to be nailing it, ethereum devs are panicking and confused as to how they can make UI/UX easier. So they default to the position of “People must hate crypto. They must have private keys. Banks don’t have private keys!” This position is short sighted. It’s like thinking what moonpay did in 2021 was sustainable and trying to build out for an ecosystem based on it. You can’t take two data points and draw a line to predict the future. You can however take what has worked over the last 16 years and figure out what people genuinely want.

So uh… what is the purpose of this piece:

This entire piece is for marketing. We are going to be launching a product soon based off of all of the points mentioned above. An L2 for onchain interacting, not for onchain transferring. We don’t want TVL, we want to help ethereum. It is partially our attempt at trying to get ethereum back on track, and partially a way of keeping all Wassies safe in this new more and more onchain ecosystem. Do not be mistaken. Onchain has won. It will take the space a few more years to realise, but the original vision of crypto is coming.

Final thoughts:

There’s alot more I want to talk about. There are other ways I think ethereum in general can improve, and should improve. A big one of these is value capture on the protocol and token level. I’d honestly say it’s a worse problem right now than the ones I have listed above in the grand scheme of things. However, before we can tackle creating a better economy, we must first build better infrastructure, so this post came first.

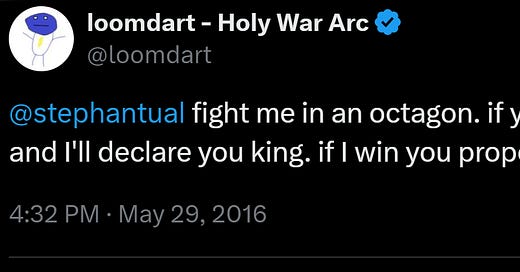

Now, before you ask “who tf is this twitter shitposter to talk about all of this” I will remind you all that I am Ethereums batman. I have protected her in the shadows for many years.

Side rant and a teaser into the next article:

A project is doing well on ETH. An L2 pitches them with a huge token grant to move over to their chain. Cheaper fees! Easier user onboarding! The project moves to the L2. Their userbase slowly disappears, their token holders sell because there’s very little liquidity. The project sells the grant they get and slowly wind down.

Is this ethereum aligned?

if I sell crack to toddlers but settle all my transactions in $ETH, am I ethereum aligned? (everyone I sent this draft to has told me to remove this line. I’m not going to.)

Last line made me laugh, glad it made the final draft. Great article man, glad you're doing this. Way prefer this over twitter

lmao